Disclaimer: This article/guide/resource is to be used for informational purposes only and does not constitute financial, business, legal or tax advice. Individuals/businesses should consult with their own accountant, business advisor, or tax advisor with respect to matters referenced in this article/guide/resource. Affinity Ledger assumes no liability for actions taken in reliance upon the information contained herein see [Terms and Conditions]. Copyright: All Works on displayed on hubpoint.info are copyrighted unless otherwise stated:

Double-Entry Accounting in Bookkeeping

What is Double-Entry Accounting

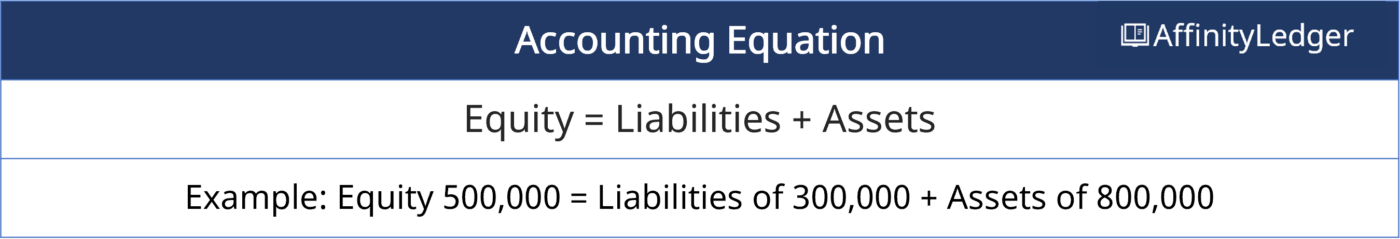

Double-entry accounting is a fundamental concept in accounting where every financial transaction affects at least two accounts: one account is debited, and another is credited. This method ensures that the accounting equation (Assets = Liabilities + Equity) remains balanced.

The Double Entry Accounting is a common bookkeeping recording method adopted by most companies even solo traders. This is because it allows the business keep track of each and every transaction in at least two accounts, which gives a more accurate picture of their finances

Every business transaction gets at least two entries a debit and a credit. These entries often detail what has came into the business and what is leaving the business

History of Double Entry Accounting

The roots of this principle were formed as early as the 12th century, in response to trade and commerce. The idea was that merchants could see the whole of their business financial situation in one go. The same principle is still used today in modern accounting systems.

It was first mentioned is Luca Pacioli’s book published in 1494. A mathematician and friar, who was known as the Italian Father of Accounting, he was the first person to publish the double entry system accounting.

Here’s a general framework for how to write double-entry accounting entries:

Basic Structure of a Double-Entry Transaction

The foundation of double entry accounting is the use of debits and credits

- Debit (Dr): An entry on the left side of the ledger.

- Credit (Cr): An entry on the right side of the ledger.

Every transaction will have:

- One or more debits.

- One or more credits.

- The total amount of debits will always equal the total amount of credits.

Steps to Write Double-Entry Accounting:

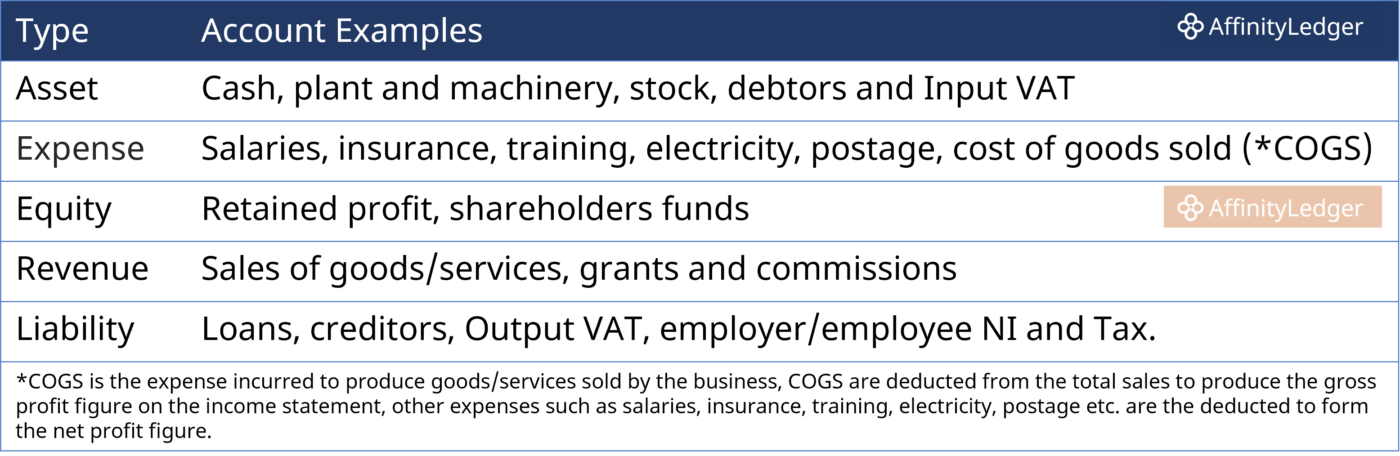

- Identify the accounts affected by the transaction.

- Determine the impact of the transaction on the accounts.

- Increase or decrease in an asset, liability, or equity account.

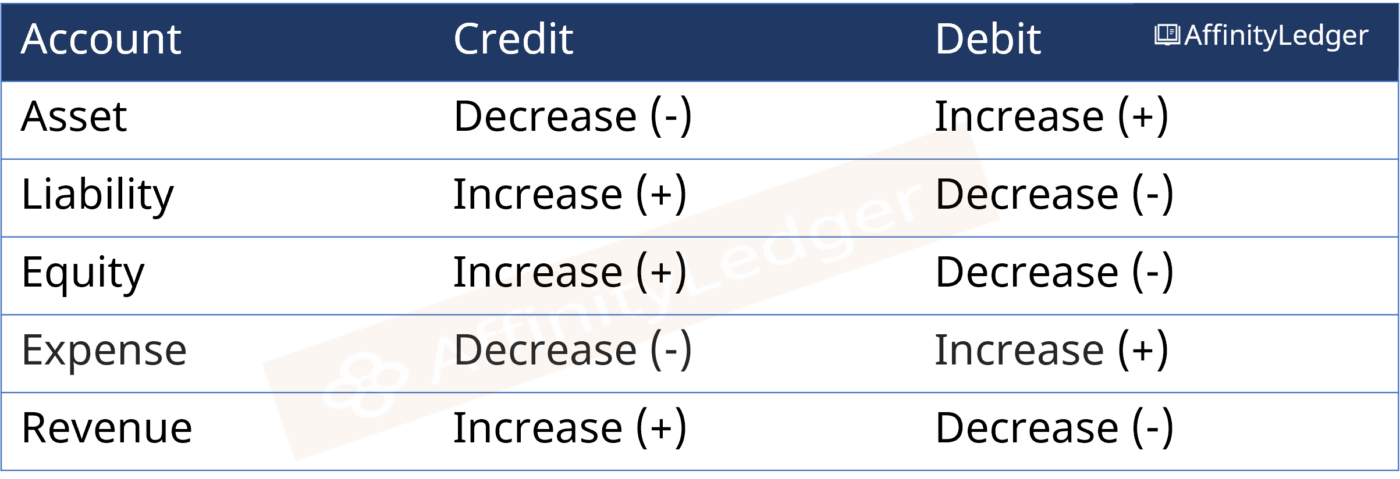

- Apply the rules of debits and credits:

- Assets: Debit to increase, credit to decrease.

- Liabilities: Credit to increase, debit to decrease.

- Equity: Credit to increase, debit to decrease.

- Revenue: Credit to increase, debit to decrease.

- Expenses: Debit to increase, credit to decrease.

Record the Journal Entry

The journal entry should reflect the accounts involved, with amounts and whether they are debited or credited.

Example 1: Purchasing office supplies on credit

Let’s say you purchased office equipment for £500.00 on credit, which means that you have say 30 days to pay. Here’s how the transaction would look:

- Identify the accounts:

- Office Equipment (Asset): This is increasing because you have more office equipment.

- Accounts Payable (Liability): This is increasing because you owe money for the equipment.

- Determine the impact:

- Office Equipment: Increase (debit)

- Accounts Payable: Increase (credit)

- Apply debits and credits:

- Debit Office Equipment for £500.00

- Credit Accounts Payable for £500.00

- Journal Entry:

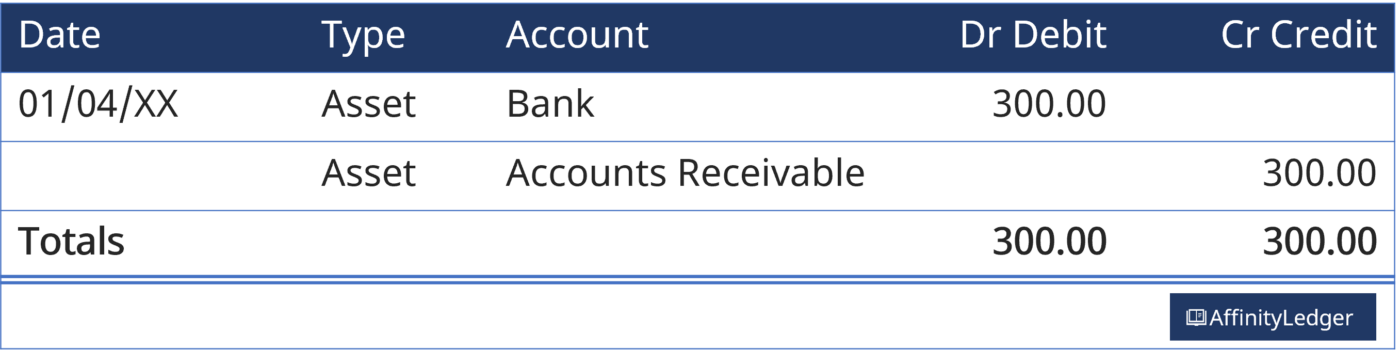

Example 2: Receiving a payment from a customer

Suppose you receive a £300.00 BACS payment from a customer for a previous sale. Here’s how the transaction would look:

- Identify the accounts:

- Bank (Asset): This is increasing because you received cash.

- Accounts Receivable (Asset): This is decreasing because the customer has paid their outstanding debt.

- Determine the impact:

- Bank: Increase (debit)

- Accounts Receivable: Decrease (credit)

- Apply debits and credits:

- Debit Bank for £300.00

- Credit Accounts Receivable for £300.00

- Journal Entry:

Example 3: Paying an expense (Rent)

Let’s say you paid £1,200.00 cash for rent. Here’s how the transaction would look:

- Identify the accounts:

- Bank (Asset): This is decreasing because you used cash to pay the rent.

- Rent Expense: This is increasing because you have an expense related to the rent.

- Determine the impact:

- Bank: Decrease (credit)

- Rent Expense: Increase (debit)

- Apply debits and credits:

- Debit Rent Expense for £1,200.00

- Credit Bank for £1,200.00

- Journal Entry:

Common Terms in Double-Entry Accounting:

- Journal: A record of all transactions.

- Ledger: A book or system where all accounts are summarised.

- Trial Balance: A report that shows the balances of all accounts and ensures the accounting equation is balanced.

Tips for Accurate Double-Entry Accounting:

- Ensure the debits and credits for each transaction always balance.

- Regularly reconcile accounts to make sure everything is up-to-date.

- Categorise transactions carefully (e.g., distinguish between income and capital).